B9 Advance App Review 2026: Up to $500 Instant Cash Advance (Fees, Limits & Best Alternatives)

B9 Advance 2026 review: Get up to $500 instant cash advance with no credit check. Real fees ($9.99–$19.99/mo), limits, pros/cons & how it compares to EarnIn, Dave, Brigit & Albert.

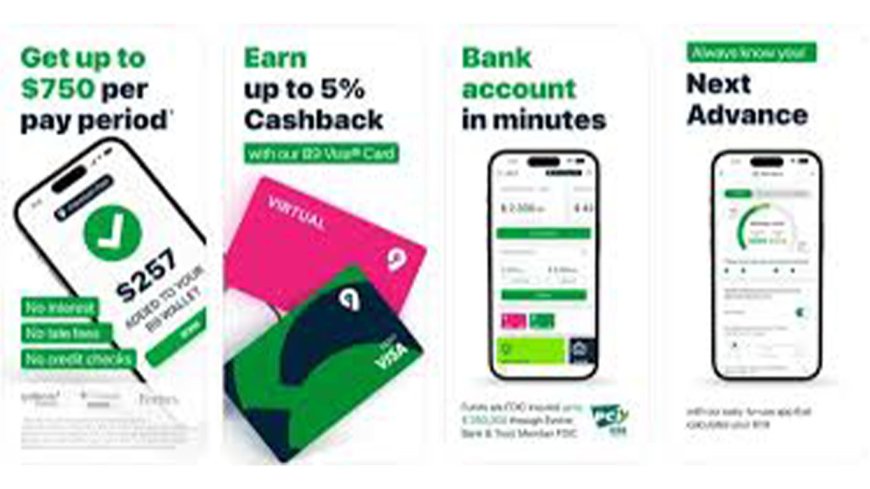

B9 Advance App Review 2026: Get Up to $500 Instantly – No Credit Check Required

In 2026, finding a trustworthy cash advance app that delivers real instant cash without insane fees or credit checks feels almost impossible. With dozens of apps pushing “optional” tips, surprise charges, and slow transfers, many people are asking the same question: Is B9 Advance still one of the best options this year? If you want to compare B9 with other popular options, you can also check out my full Dave Advance Review, where I break down fees, limits, and approval speed.

This complete, up-to-date B9 Advance review for 2026 reveals everything you need to know before downloading that is to say real fees, actual advance limits, eligibility rules, speed tests, user experiences, and honest comparisons with top competitors like EarnIn, Dave, Brigit, Albert, and Empower . By the end, you’ll know exactly whether B9 deserves a spot on your phone in 2026 or if there’s a better instant cash app for your needs. You may also like my detailed Albert Advance Review 2025–2026, especially if you prefer apps that combine budgeting tools with cash advances.

What Exactly Is B9 Advance in 2026?

B9 Advance is a membership-based cash advance and banking app that lets eligible users access up to $500 of their upcoming paycheck instantly and without any credit check. Instead of charging interest or begging for tips like many competitors, B9 uses a simple flat monthly membership fee. This transparent pricing model has made it extremely popular among people who need cash advances regularly and hate surprise costs.

Key 2026 features include:

- Instant cash advances up to $500

- Zero interest & no late fees

- FDIC-insured partner bank

- Early direct deposit (up to 2 days faster)

- Optional B9 debit card for instant transfers

- Cash load locations nationwide

For frequent borrowers tired of tipping culture, B9 feels refreshingly straightforward. For more alternatives, my Empower Advance Review explains how Empower’s cash-advance limits differ from B9’s system.

How Does B9 Advance Actually Work in 2026? (Step-by-Step)

Getting money with B9 is designed to be fast and simple:

- Download the B9 app (iOS or Android) and create an account

- Verify identity and link your employer/payroll info

- Switch direct deposit to your new B9 account (required for max limits)

- Wait for B9 to analyze your income pattern (usually 1–2 pay cycles)

- Request your advance instantly transferred with Premium membership

- Repayment happens automatically when your paycheck lands

In 2026, users consistently report the entire process from request to cash in hand takes under 60 seconds for Premium members making B9 one of the fastest legitimate cash advance apps available. If you’re looking for more apps like B9, my guide on the Top 10 Cash Advance Apps in 2025-2026 is a great place to compare approval speed and fee structures.

B9 Advance Limits in 2026 – How Much Can You Really Get?

Your borrowing limit depends on your account history and whether you route your paycheck through B9:

|

User Type |

Typical Advance Limit |

|

Brand-new users |

$30 – $100 |

|

Verified income (no DD) |

$150 – $300 |

|

Direct deposit established |

Up to $500 |

Your limit can increase over time when you:

- Keep using B9 as your main banking account

- Receive consistent paychecks

- Repay advances on time

- Maintain positive balance history

Pro tip in 2026: The fastest way to unlock the full $500 limit is to switch your direct deposit immediately after approval.

B9 Advance Fees 2026 – The Truth About Costs

B9 completely eliminated “optional tips” and instant-transfer fees. Instead, everything is covered by two clear membership plans:

B9 Basic – $9.99/month

- Lower advance limits

- Standard transfer speed (1–3 business days)

- Basic support

B9 Premium – $19.99/month (most popular in 2026)

- Instant transfers in seconds

- Higher advance limits & faster limit increases

- Priority customer support

- Full access to all features

There are literally no other fees and no interest, no late fees, no overdraft charges, and no hidden costs. For anyone borrowing more than once or twice a month, the $19.99 Premium plan is usually cheaper than competitors that charge $3–$15 per instant transfer plus tips. If you’re searching for other ways to boost your income, you can also read my post on the Top 7 Legit Microtask Sites in Africa 2025, which pay daily for simple tasks.

Who Actually Qualifies for B9 Advance in 2026?

B9 focuses heavily on verifiable, regular income. To qualify you need:

✓ At least two recent paychecks from the same employer

✓ A traditional W-2 job (most gig-only workers are declined)

✓ Valid government ID and SSN

✓ U.S. bank account

✓ Direct deposit switched to B9 (for limits above $300) Unfortunately, many DoorDash, Uber, and freelance-only workers still get rejected in 2026. If that’s you, EarnIn or Empower are usually better options.

For small side-income opportunities, my guide on the Top GPT Sites in 2025 shares easy platforms that pay for watching videos, clicking ads, and taking surveys.

How Fast Is B9 Really in 2026?

Speed remains one of B9’s biggest advantages:

- Basic plan: 1–3 business days

- Premium plan: 95%+ of transfers hit your account in under 2 minutes

Independent user surveys in 2026 rank B9 as the #2 fastest cash advance app (only behind EarnIn’s lightning mode for some users).

Is B9 Advance Safe and Legitimate in 2026?

100% yes. B9 partners with FDIC-insured Evolve Bank & Trust, uses bank-level encryption, and has served millions of advances without major security incidents. The company is not a lender but you’re simply accessing money you’ve already earned. Repayment is automatic, so there’s no debt collection or credit reporting.

B9 Advance Pros & Cons (Real 2026 Experience)

Pros

- Truly instant cash with Premium

- No credit check ever

- Up to $500 limit (one of the highest)

- Predictable flat monthly fee

- No tips, interest, or late fees

- Early direct deposit

- Clean, reliable app interface

Cons

- $19.99/month can feel expensive for occasional use

- Requires direct deposit for best limits

- Not friendly to gig-only workers

- Fewer budgeting tools than Brigit or Albert

You might also find my beginner-friendly guide on how to manage money on a tight budget helpful, especially if you’re using B9 to smooth out monthly expenses.

B9 vs Top Competitors – 2026 Comparison Table

|

App |

Max Advance |

Monthly Cost |

Instant? |

Best For |

|

B9 |

$500 |

$9.99 – $19.99 |

Yes |

Fast, predictable, high limits |

|

EarnIn |

$750 |

Tips only |

Yes |

Highest limits, gig workers |

|

Dave |

$500 |

$1 + tips |

Yes |

Beginners, small advances |

|

Brigit |

$250 |

$9.99 |

Yes |

Budgeting + overdraft alerts |

|

Albert |

$250 |

$14.99 + instant fees |

Yes |

All-in-one banking & investing |

|

Empower |

$300 |

$8/month |

Yes |

Gig workers & credit building |

|

Klover |

$200 |

Points/Ads |

Yes |

No subscription |

Winner by category in 2026:

- Highest limit → EarnIn

- Fastest & most reliable instant transfer → B9 Premium

- Best for budgeting → Brigit

- Cheapest for rare use → Klover or Dave

Is B9 Advance Worth It in 2026? (Honest Final Verdict)

Yes, but only for the right person. B9 Advance is an excellent choice in 2026 if you:

- Have a regular W-2 paycheck

- Need cash advances multiple times per month

- Want truly instant transfers without tipping

- Value predictability over the absolute lowest price

- Plan to use B9 as your main banking app

It’s NOT ideal if you:

- Only need cash once in a blue moon

- Work 100% gig jobs with no traditional paystubs

- Refuse to pay any monthly subscription

- Want advanced budgeting or investing tools

For frequent borrowers with steady jobs, the $19.99 Premium plan often saves money compared to apps charging $5–$15 per instant advance.

Top B9 Alternatives in 2026 (If B9 Isn’t Right for You)

- EarnIn – Best for gig workers & highest limits ($750)

- Dave – Lowest barrier to entry for beginners

- Brigit – Best built-in budgeting tools

- Albert – Full banking + investing in one app

- Empower – Great for building credit while borrowing

- Klover – Truly free (no subscription)

Final Thoughts: Should You Download B9 Advance in 2026?

In a market full of confusing tip prompts and hidden charges, B9 Advance stands out as one of the most transparent and reliable cash advance apps in 2026. If you have a steady paycheck, value lightning-fast transfers, and don’t mind a reasonable monthly fee, B9 Premium delivers one of the best overall experiences available today.

Download link & current promo (as of December 2025): Many users still get the first month of Premium for just $9.99 but check the app for latest offers. Ready for instant cash without the games? B9 might be exactly what you’ve been looking for in 2026. If you’re working toward long-term financial stability, you can also read my simple guide on how to start investing with little money, which pairs well with the budgeting tools B9 offers.

What's Your Reaction?